Across West Africa, the tax-to-GDP ratio is still around 10.8%, far below the global average of 15%. According to the African Development Bank this represents a missed opportunity of approximately $50 billion annually of revenue. The low ratio reflects challenges like narrow tax bases, evasion and inefficient manual systems. Unlocking this potential requires more than political will or change in legislation, it demands the deployment of ETax systems that enable a digital transformation of the tax administration process.

What Is Digital Transformation?

Digital transformation is a way of continuously deploying digital technology at scale across all areas of an organization, business, company or process. But it is not merely the adoption of new technologies; it is a holistic reimagining of how organization operate, deliver value to both employees and customers and interact with stakeholders. E-taxation, or electronic taxation, is the transformation of the entire tax administration process. This includes transforming online filing, electronic payments as well as digital record-booking with the use of digital technologies.

According to the International Accounting and Taxation Research Group, Faculty of Management Sciences, University of Benin, the Federal Inland Revenue Service (FIRS) introduced e-taxation in 2013 in an attempt to shift toward digital tax administration. The system includes e-services such as e-Registration, e-Payment, e-Filing, e-receipt, e-Stamp duty, and e-Tax Clearance Certificate (e-TCC), supported by platforms like the Nigeria Inter-Bank Settlement System (NIBSS), Remita, and Interswitch. According to the Research Group, post-2013, federal revenue saw a 50% increase, rising from an average of N3.051 trillion (2006-2012) to N4.467 trillion (2013-2019).

Lagos ETAX System: A Case Study

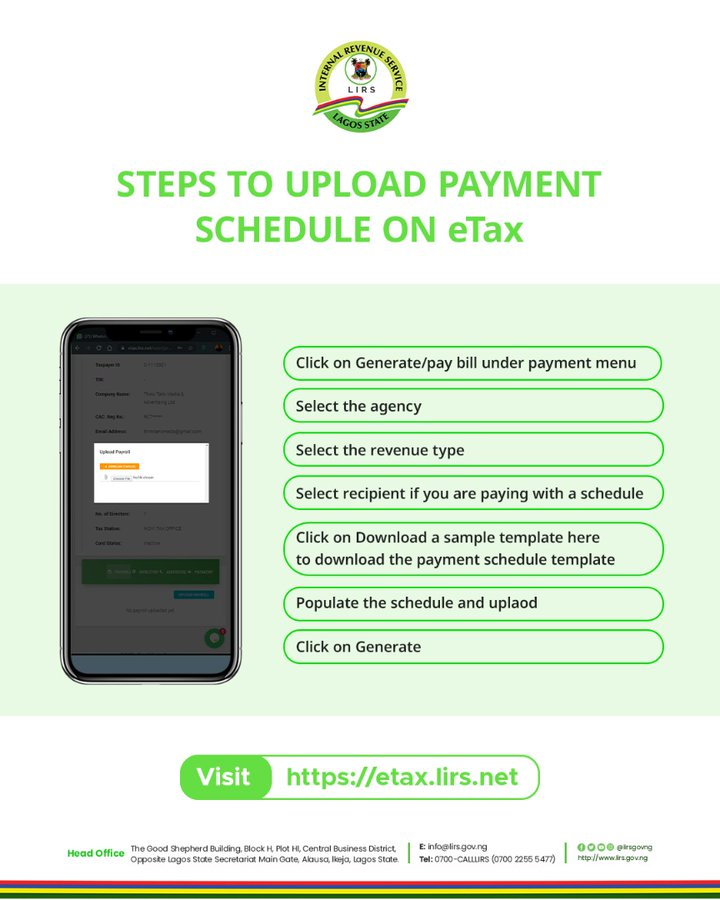

A cornerstone of Lagos’s success is its tax collection system. In 2019, the state revealed that of its 4.8M registered taxpayers, only about 700,000 were compliant. In September of the same year, it launched the ETax portal. Prior to 2019, tax filing in Lagos was a cumbersome process that involved long queues, extensive paperwork and a five-day waiting period. This often deterred compliance and understandably so. The platform revolutionized this system.

The ETax platform is unified digital platform where Lagos residents can file their taxes and make sundry payments via web, mobile and USSD codes for basic phone users. Created for ease of compliance, the platform spared people from having to remember payment references and codes and visiting designated banks. Taxpayers could file tax returns online, get their receipts, and access an online calculator to assess taxes directly.

The platform’s impact has been profound. It allowed processing times to drop from five days to minutes thus, significantly reducing compliance costs. According to Dataphyte, Lagos State’s tax revenue increased from N390.406 billion in 2021 to N593.885 billion in 2023, thanks to ETAX.

Key features of the platforms include integration with land registries and business permits and automated audits that reduced corruption. Mobile platforms enable small, frequent contributions, while gamified apps reward timely filings.

ETax: The Case of Rwanda

Rwanda’s mandated e-taxation since 2015 as part of its digitalization strategy. It integrated tax e-services and mobile money platforms like MoMoPay for merchant payments. During COVID-19, adoption surged to 90% due to social distancing and fee waivers, but many reverted to cash when fees were reintroduced, highlighting the impact of transaction costs. The challenges included up to 19% of corporate and 40% not being aware of the service. A significant majority, about 88% of merchants preferred cash, with only 18% believing that tax authorities Rwanda Revenue Authority accesses mobile money data. There were also barriers for female, less educated and less IT-savvy taxpayers, which are often exacerbated by technical issues like slow systems and unsatisfactory online assistance.

Regardless, the benefits of the service include improved tax compliance and perceived fairness, though the impact was limited, with only personal account users (no fees) perceiving a fairer system. Rwanda’s experience suggests that Nigerian states must address user familiarity, reduce transaction fees and ensure robust technical support.

Steps For Deployment ETax Platforms

Drawing on these insights, states can adopt the following steps to deploy ETax systems:

- Develop Robust ICT Infrastructure by investing in reliable internet connectivity, secure servers and user-friendly online platforms. Also, the platforms must be compatible with desktops, tablets and smartphones to cater to diverse users.

- Create User-Friendly E-Tax Portals: This would require developing intuitive platforms for tax registration, filing, payment and receipt issuance. The platforms should include features like tax calculators, automated reminders, and multilingual support to enhance accessibility.

- Prioritize Data Security and Privacy: Since privacy is an important concern online, adopting states need to implement advanced security measures, such as encryption and firewalls, to protect taxpayer data. Also, they need to conduct regular security audits and updates to mitigate cyber threats to be able to address concerns like hackers and other ICT-based disasters noted in federal implementations.

- Promote Awareness and Education Among Residents: This can be done through the launch widespread campaigns, including workshops, seminars and online tutorials that can educate taxpayers on e-taxation benefits and usage. Particularly, rural and less educated populations should be targeted to bridge digital literacy gaps, as seen in Rwanda’s challenges.

- Provide Technical Support: The platforms should integrate helplines, chat support, or physical help desks to assist taxpayers with technical issues. Support should also be accessible in local languages to cater to diverse demographics.

- Enforce Compliance: Implement penalties for non-compliance and incentives, such as discounts, for timely filing and payment. Data analytics can be used to identify and address non-compliant taxpayers, as Lagos State has done with enforcement measures.

- Integrate with Other Government Services: Link e-taxation systems with national identity databases like NIN or BVN or other government platforms to streamline processes. This would help reduce duplication, enhance efficiency and simplify taxpayer registration, as recommended for integrated tax administration systems.

- Monitor and Evaluate: Deploying states should regularly assess system performance by gathering feedback from users to identify areas for improvement. Use insights to make continuous enhancements, ensuring long-term sustainability, as suggested for regular ICT infrastructure updates.

Tax Administrators Should Prepare for These Challenges

Deploying e-taxation systems will face challenges, including:

- Security Concerns: Protecting sensitive data from cyber threats is critical. Robust security measures, like those recommended for federal systems, are necessary.

- Low Digital Literacy: Many taxpayers, especially in rural areas, may lack skills or access to digital platforms. Mitigation involves targeted education campaigns and community outreach.

- Resistance to Change: Some may prefer traditional methods due to distrust or familiarity. Awareness campaigns and demonstrating benefits, like convenience, can help.

- Technical Issues: System downtime, slow performance, or rejected declarations can frustrate users. Regular maintenance and technical support are essential.

- Transaction Fees: High fees for digital payments, as seen in Rwanda, can deter adoption. States should negotiate lower fees with payment platforms or subsidize costs initially.

In Conclusion

The federal e-taxation system, implemented via the Integrated Tax Administration System (ITAS), provides a foundation for states. However, state-level deployment requires addressing local challenges, such as varying levels of digital infrastructure and taxpayer demographics. Lagos’ success suggests that states with stronger economic bases and ICT readiness can lead, while others may need phased approaches, starting with pilot projects in urban areas and then expanding.

E-taxation offers Nigerian states a pathway to enhance revenue collection, improve compliance, and foster economic growth. By learning from Lagos State’s model and international examples like Rwanda, states can deploy effective systems through robust ICT infrastructure, awareness campaigns, and security measures. While challenges like low digital literacy and technical issues exist, the long-term benefits of transparency, cost savings, and economic impact make e-taxation a strategic priority for Nigeria’s future.

For states looking to transform their tax systems, NQLB offers proven expertise in digitization, having successfully built the e-tax platforms for both Lagos IRS and FIRS. Our tailored solutions ensure efficient, secure and user-friendly e-taxation systems to boost revenue and compliance. Contact NQLB today to explore how we can support your state’s digital tax journey!